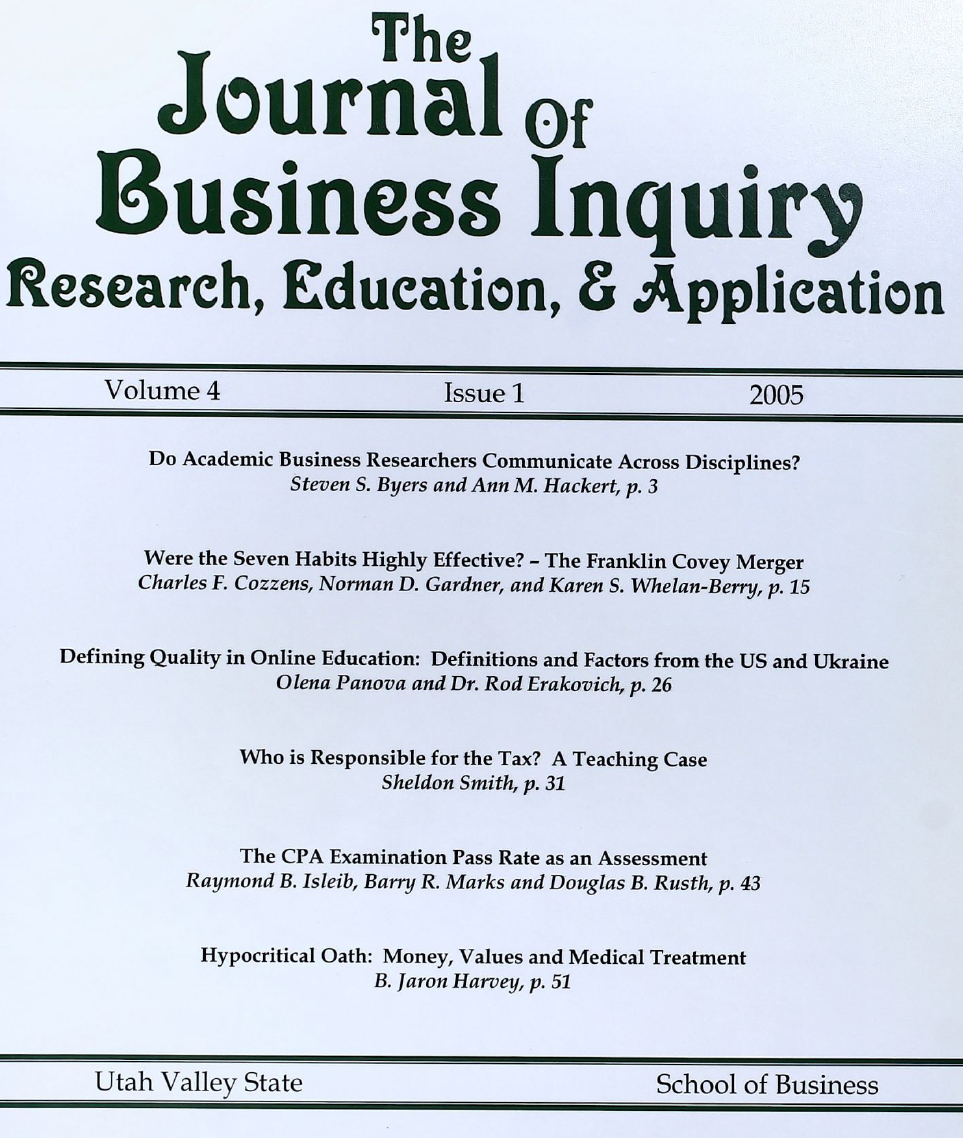

Were the Seven Habits Highly Effective? The Franklin Covey Merger

Keywords:

Merger, Merger Outcomes, Training Industry, Financial ResultsAbstract

This case explores the merger between Franklin Quest and the Covey Leadership Center, along with its aftermath. The objective is to provide students the opportunity to consider the many facets of the merger including the impact of the backgrounds and corporate cultures of the merging parties, the subsequent financial and operating results, and external factors including the economy and competition. This case also provides students the opportunity to sharpen their analytical and research skills as they access the SEC website and EDGAR database as well as other websites that provide economic and industry related information for the answers to specific questions.

An example of how the merging of two separate companies- even in the same industry with perceived complimentary products and services, similar cultures, and optimistic senior executives-can often take years to determine whether the merger was a good decision or not is presented in this case.

After presenting an overview of each of the pre-merger companies, the merged company-with many of its subsequent internal developments-is also presented for analysis. External factors, such as the possible impact of 9/11 as well as economic and other changes since the merger are also presented. The question to be addressed is: Was the Franklin Covey merger successful or

not?

This case is appropriate for use in an advanced business policy or strategy class, or management class, in an organizational behavior class, or in a corporate finance or entrepreneurship class. ft can also be used as a merger and or merger management case. The case could take from one half to two hours of class discussion. Students will require three to four hours of preparation

time.