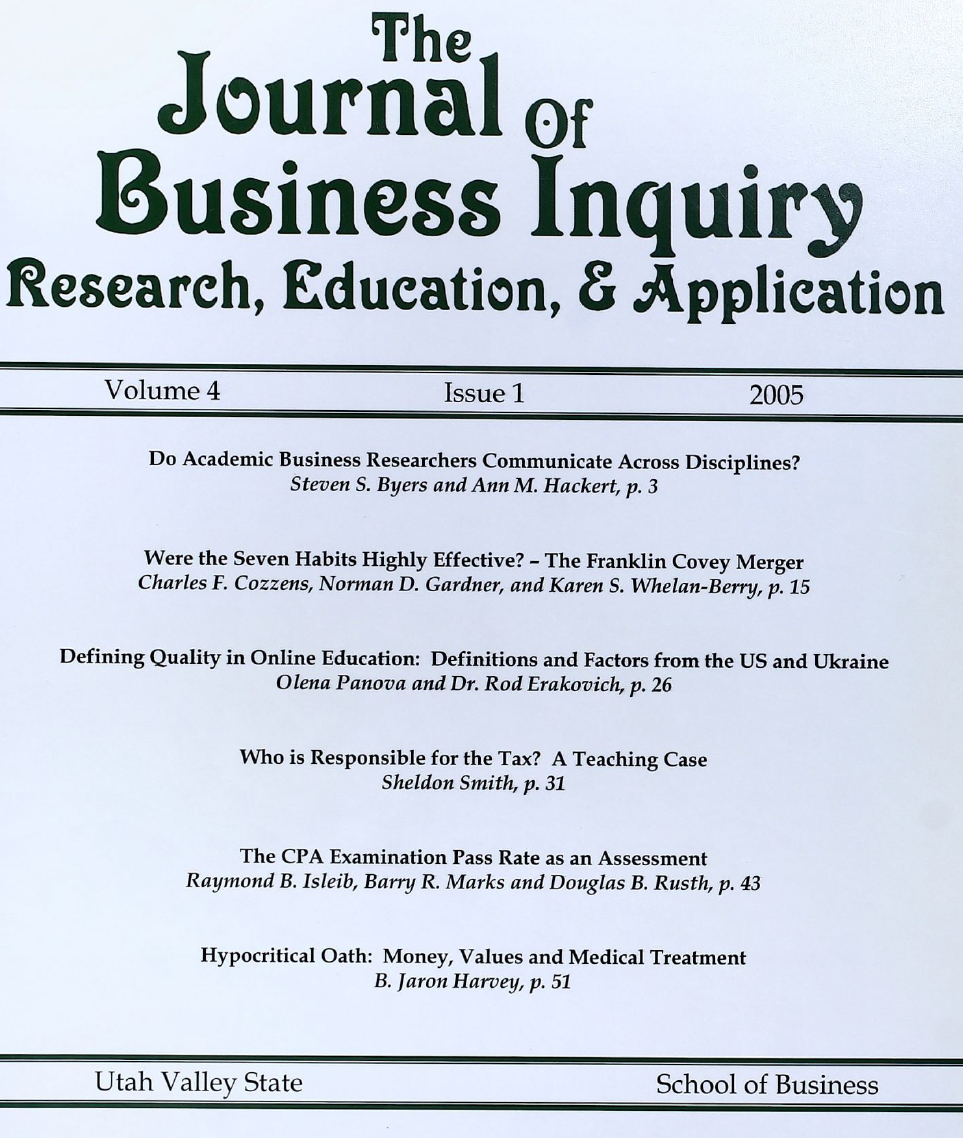

Who is Responsible for the Tax? A Teaching Case

Keywords:

Hawaii General Excise Tax, Sales Tax, Insurance, Flexible Spending AccountsAbstract

This teaching case discusses a specific situation involving an employee, the employer's dental plan, and a dentist. It allows students to consider a unique situation which arose because of misunderstandings of how the Hawaii general excise tax (GET) differs from a sales tax. In addition, taxes, insurance, contracting, and flexible spending accounts are also discussed in general terms. The case is flexible and allows for either basic discussion or critical thinking. It can be used in a variety of business classes.

Downloads

Published

2005-07-01

Issue

Section

Articles