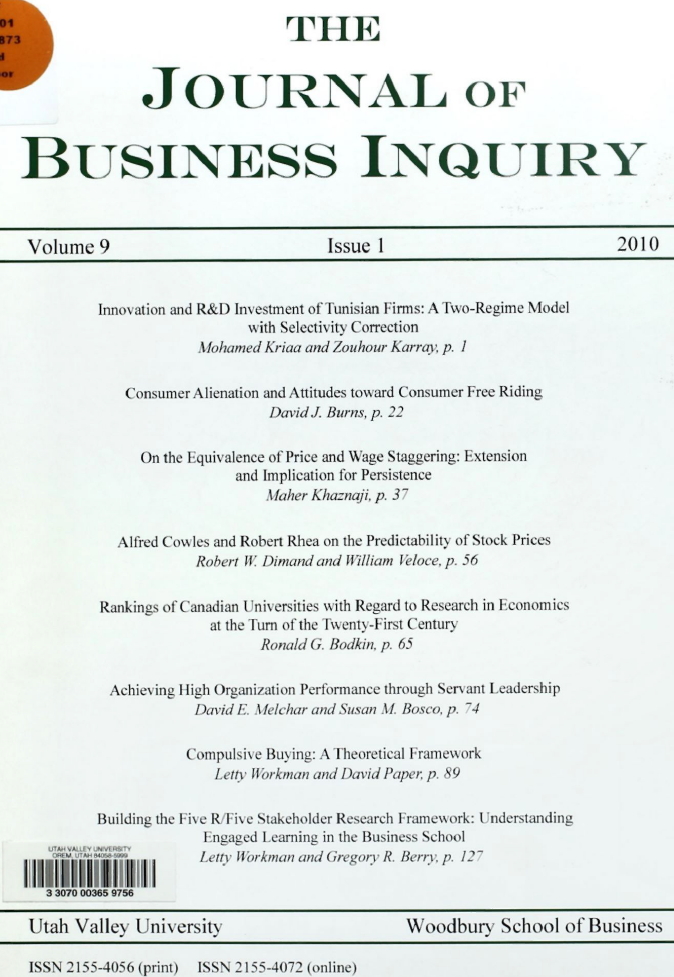

Alfred Cowles and Robert Rhea on the Predictability of Stock Prices

Keywords:

Dow Theory, Predictability of Stock Prices, Alfred CowlesAbstract

Brown, Goetzmann, and Kumar (1998) show that Cowles's test of Hamilton's version of the Dow Theory was flawed: Cowles compared rates of return without adjusting for risk. A similar argument against Cowles' test was published by Rhea (1933). Furthermore, Cowles (1944) accepted that there was one stock market forecaster whose prolonged record of success could not be attributed to chance (but whom Cowles did not name). Cowles and Jones (1937), cited by Malkiel (1987) and Harrison (1997) as showing that stock price changes are random and without predictable structure, actually reported the opposite conclusion, but that result was demonstrated by Cowles (1960) and Working (1960) to be in part an artifact of the averaging technique used.

Downloads

Published

2010-07-01

Issue

Section

Articles