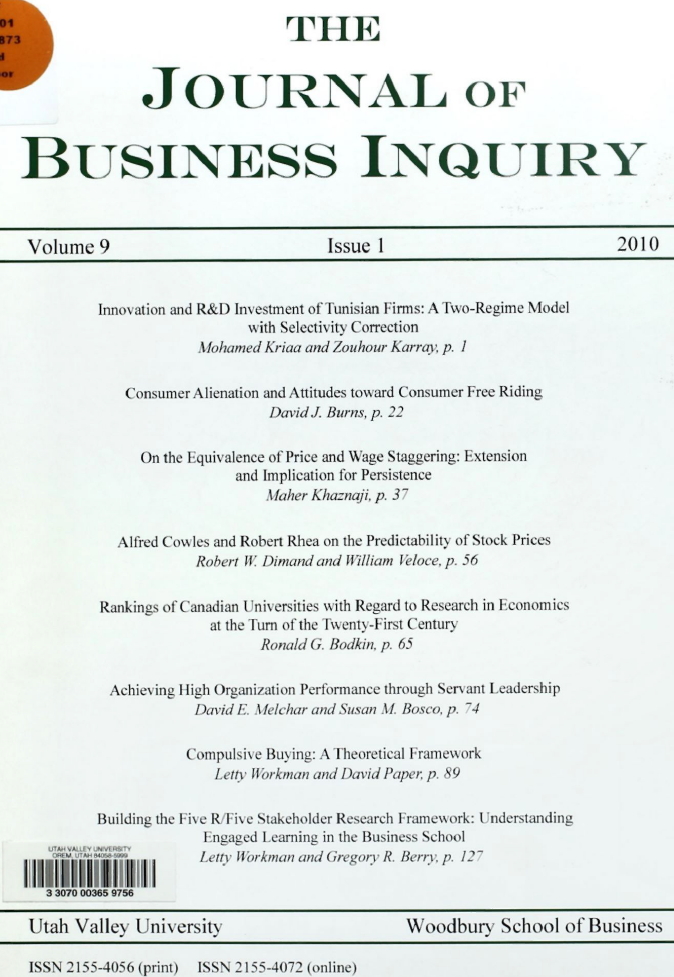

Innovation and R&D Investment of Tunisian Firms: A Two-Regime Model with Selectivity Correction

Keywords:

Innovation, R&D, Spillover, Absorptive Capacity, Selectivity CorrectionAbstract

The purpose of this paper is to produce new empirical evidence on the determinants of Tunisian firms R&D investment, by considering the effect of innovation probability of firms on R&D investment. We estimate econometric models of selectivity correction (Heckman 1976 and 1979; Lee 1976 and 1978) and consider a sample of 321 firms during the period 2002-2005. On the one hand, the results show the positive impact of R&D activities, human capital quality, past experience in innovation and public subsidies on probability of firms to innovate; whereas, ownership structure has a negative impact. On the other hand, we estimate the determinants of R&D expenditure for the two groups of firms (innovating and non-innovating). There are spillover effects only for innovating firms that have an absorptive capacity. Finally, ownership structure has a significant impact on R&D investment especially for foreign controlled firms.